The Importance and Customisation of an Effective Customs Strategy in the Post-Brexit Era

Companies with a coherent customs strategy are generally better at gaining a competitive advantage than their peers but … surprisingly few have one.

Now we have left the EU, 100% of customs duty is collected by the UK exchequer at a time where the nation has a significant covid debt to repay. We are seeing a much more proactive HMRC regarding how they are monitoring and enforcing customs compliance. With this in mind, businesses can no longer overlook this critical area.

Once an effective customs strategy is in place, resources are better directed and decisions are easier to make, but Customs strategy is not a one-size-fits-all. It is best tailored to fit in with your company’s vision, culture and broader business strategy.

What is a Coherent Customs Strategy?

In general terms, an coherent customs strategy allows you to:

- Proportionately manage material customs risks and meet your legal obligations;

- Reduce costs to improve margins.

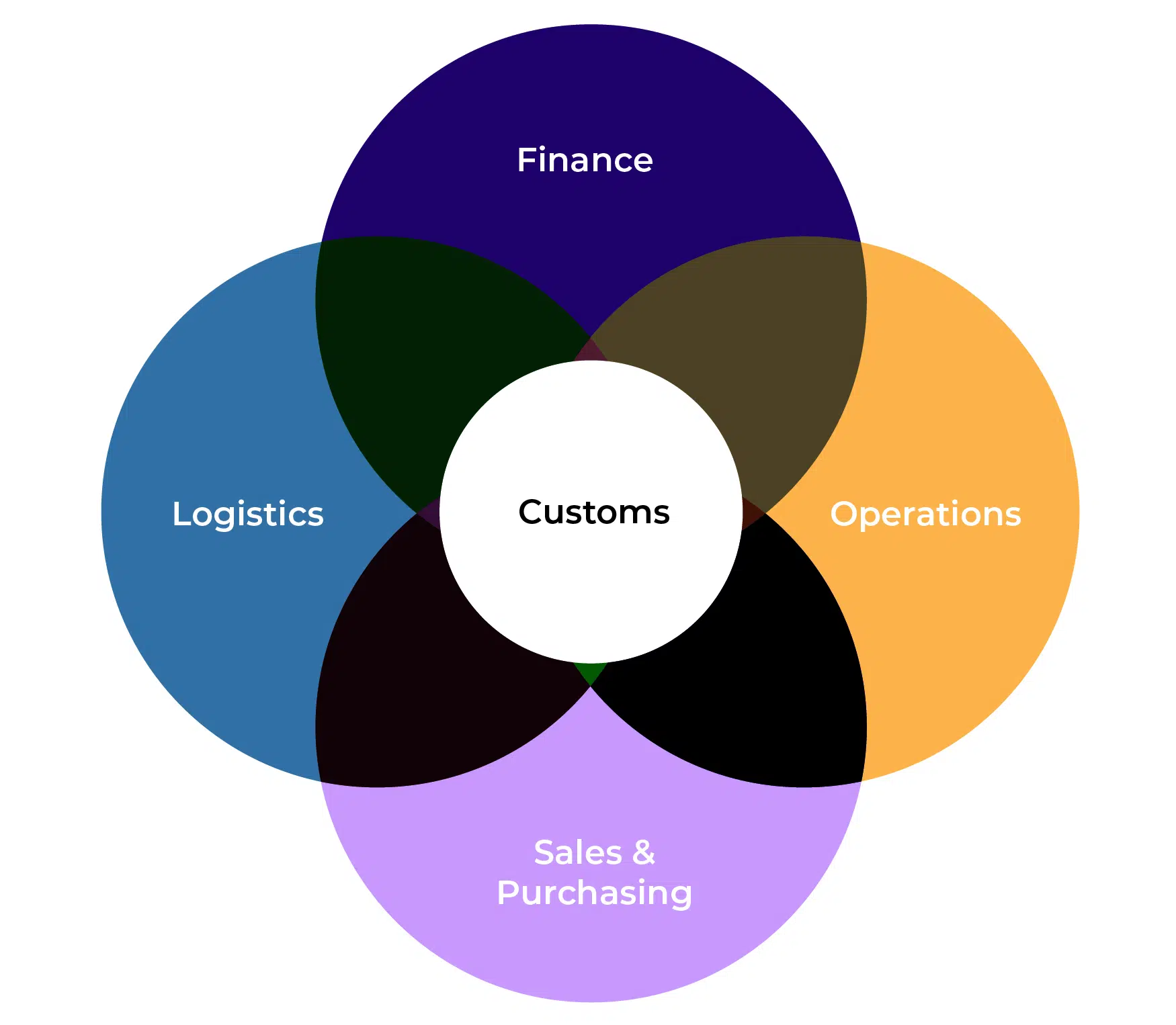

So why do most firms not have a clear strategy in place? We have found that organisations struggle to get a good handle on their customs landscape because the day to day responsibility is typically spread across multiple departments.

This lack of responsibility manifests itself in three ways:

- Significantly increases risk;

- Drives up the cost of sales;

- Lack of a streamlined approach and overarching strategy.

How do I achieve this?

Rather than creating the customs strategy in a vacuum, there are a number of considerations it should reflect:

- Materiality;

- The Power of Buyers and Sellers;

- Supply chain considerations;

- Wider Group Considerations; and

- The Regulatory Footprint.

Materiality

All businesses are keen to comply with their legal obligations.

But how far is the company willing to go to ensure they meet your customs regulatory obligations? What does the business consider a material risk or opportunity? How much resource should be put into the system for making customs declarations and ensuring the company does not overpay or underpay customs duties?

The answer to these questions depends on materiality in absolute and relative terms.

Absolute Materiality

Customs is subject to audit based control, meaning imports and exports remain open to assessment for three years. Any errors can result in:

- Collection of underpaid duty

- Unnecessary overpayment of duty

- Penalties (up to the value of any underpaid duty)

- Reputational damage with HMRC, leading to audits and port inspections

- Supply chain delays from higher rates of examination at port & queries

- Removal or exclusion from customs simplifications or relief programs

So what are the businesses current customs costs? What is our current error rate? How much does the business save under any reliefs of simplifications?

Businesses often struggle to answer these fundamental questions because the necessary data is not available to the right people. Lack of visibility stems from companies outsourcing the completion and submission of customs declarations to several third parties (freight agents or customs brokers).

Relative Terms

Customs risks are relatively higher for businesses with more significant imports in their Cost of Goods Sold (COGS) and narrow gross profit margins. An additional percentage on costs from a retrospective duty demand will hit these companies harder.

Businesses with low COGS, small imports over local supplies, and high margins are more resilient to additional customs duty costs or retrospective demands.

Some businesses have high hidden customs costs and risks when sourcing from local companies that import goods. These costs are passed on in the price of goods. Compliance errors by these suppliers could cause supply chain interruptions outlined above. Always look at key or critical supplies when considering your customs strategy.

Top Tip:

Businesses can obtain details of their customs declarations from HMRC in digital form to analyse customs costs, savings etc. The data (known as MSS) costs £240 + VAT per annum per standard

report. Barbourne Brook has developed a software application that automates analysis, using best practices from over 35 years of consulting experience.

Find out more about how our Customs Analytics software can help you.

The Power of Buyers and Sellers

The relative power of your buyers and sellers may impact your customs strategy, if they dictate the choice of Incoterms in your contracts.

The Incoterms are short-hand for who acts as exporter and importer, who bears the cost of transport, insurance, customs declaration fees and customs duty. The norm is for the person in-country to take on responsibility for dealing with their customs issues.

Buyers may insist on Incoterms whereby you take responsibility for all customs formalities and costs or face losing their business to local providers. We know many EU customers demand UK companies bear these responsibilities since Brexit.

If your business sells through small distributors, businesses unaccustomed to international trade or consumers, then it may be impractical for them to take responsibility for customs, forcing you into selling Delivered Duty Paid (DDP).

Suppliers may sell through local distributors and dictate that they take on customs costs, which are passed on in their prices. Others may only be willing to sell to you if you take all responsibility (e.g. on ex-works terms).

Supply Chain Considerations

Customs considerations are taken in the context of broader supply chain thinking. Businesses consider supply chain issues around:

- Robustness of the supply chain;

- Speed;

- Cost sensitivity;

- Preferences for global or local sourcing; and

- Flexibility.

Does it make sense for the business to source its supplies globally? Tapping into a global market generally brings wider choice, better quality and lower cost. But these advantages come at the expense of greater complexity and risk.

In recent years, we have all seen the impact of vulnerabilities in global supply chains, and Just in Time principles are now under scrutiny. International transport costs and supply chain delays are hot topics. Supply chain professionals within your businesses may be looking at current trade-offs between resilience through holding more extensive stocks, dual-sourcing critical supplies and additional costs.

Now would not be the time to implement significant customs planning if the business moves from importing to local sourcing. Conversely, if the company is looking to build up stocks, regimes like customs warehousing could offset some pressure on cash-flows.

Changes to supply chains such as who and where you are souring from, holding stocks, and selling to will all have customs costs and risk implications.

Wider Group Strategy

Related party transactions account for the majority of UK international trade movements. If your company is part of a broader group, the more comprehensive group strategy bears on your customs strategy.

The group business model is likely to determine who does what, where, who sells into specific markets, where risks and profits reside etc. Your strategy may need to be defined within the context of this broader model.

Regulatory Footprint

Specific industries are subject to greater regulation than others. For example, chemical companies may also need to look at REACH provisions and require the importer to comply with non-tariff obligations that depend on registration and establishment conditions.

The aerospace industry requires clear product audit trails back to source, demanding tighter processes and systems. The culture of companies in this sector supports use of automated customs regimes.

Other businesses are subject to greater regulation because of their size. For example, companies with turnover greater than £200m must comply with Senior Accounting Officer (SAO) provisions, making the Senior Finance Officer in the business personally responsible for ensuring adequate processes to account for tax, which includes customs duties.

A more significant regulatory footprint usually demands more investment in customs strategy.

Five Steps to Implementing a Coherent Customs Strategy

Step One Determine where you are today with regards to materiality, processes, current planning, risk mitigation

Step Two Set up a round table discussion with all stake holders to explore broader business requirements, including exploration of the above considerations, Customs management does not sit neatly within any business function but impacts many, including:

-

- Supply chain (for the above reasons);

- Finance will want to manage the relationship with HMRC, control any audits etc. If the business has a turnover of £200m plus, then the Head of Finance is personally liable for ensuring the company has adequate customs compliance systems under Senior Accounting Officer provisions;

- Purchasing: Will have goals with suppliers around Incoterms, frequency of shipments, minimum order quantities and the contract terms could include customs opportunities and threats;

- Sales: Will have goals with customers similar to procurement.

Step Three Devise a coherent strategy that addresses the business needs as a whole, including what needs doing and what you should stop doing;

Step Four Implement the strategy with clear feedback loops to ensure it is working; and

Step Five Continual Improvement of performance against that strategy to take account of feedback, business changes, customs regulatory changes etc.

The Next Steps

Getting your customs strategy right has never been more critical. Businesses usually approach this project in one of three ways:

Do Nothing

Clearly not advisable given the significant compliance risk, but surprisingly, this is often the case.

Hire In-House Expertise

Customs experts are in demand and, as such, an internal hire can be upwards of £70,000. Most of the high-value project work will be done within the first 18 months, so you are then left with a high cost for a primarily administrative position.

Engage with Barbourne Brook

Barbourne Brook can build, implement and manage your customs strategy using tried and tested methods developed over 30 years and work with clients to speed up development of strategy, bringing experiences of thousands of other businesses.

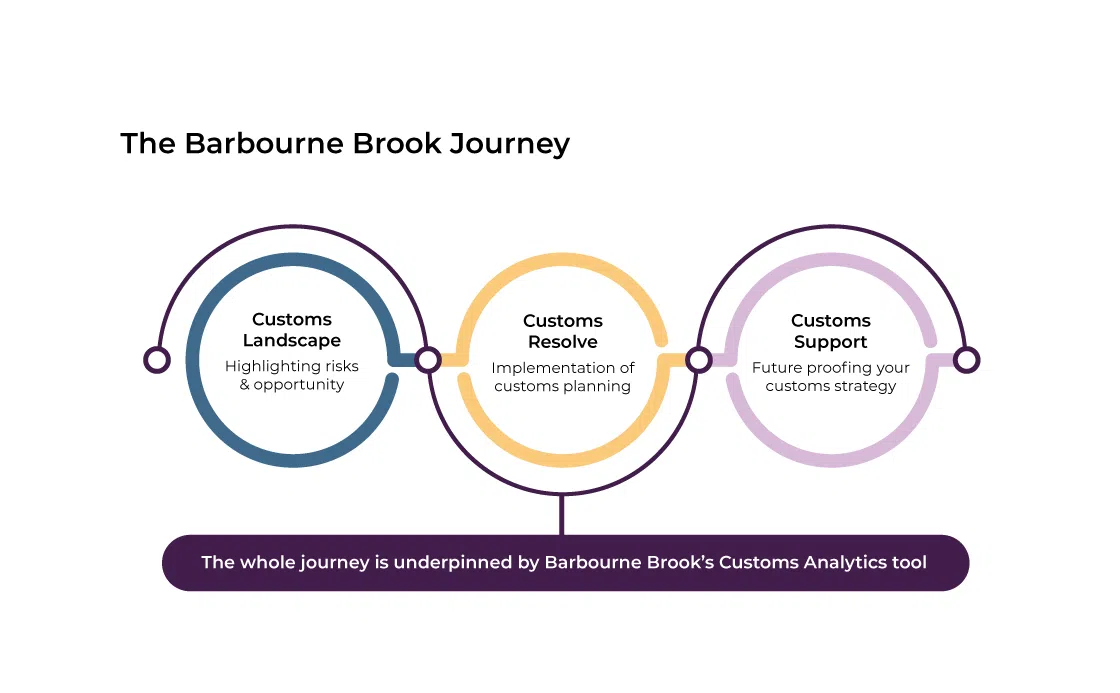

The first step is a full review of your customs obligations to uncover hidden risks and opportunities within your customs sphere. This is known as our Customs Landscape which is deep-dive review of your core elements (classification, origin and valuation), systems, processes and procedures.

Find out more about Customs Landscape here.

Once we have completed Customs Landscape, we move you onto the implementation of customs planning and then future-proof your business through ongoing support with our Customs Support Service.

Related Posts

15 July 2024

Customs Traps: The High Price of a Blinkered Approach to Transfer Pricing

Businesses selling direct to customers…

10 June 2024

New Scheme Offers Declaration-Free Exporting To Northern Ireland For B2C Businesses

Businesses selling direct to customers…