FOFO and Its Impact on UK Business Finance Teams

FOFO is a term familiar in the medical community to describe the psychological barrier that stops people from seeking medical advice. But how does this same phenomenon affect UK business finance teams?

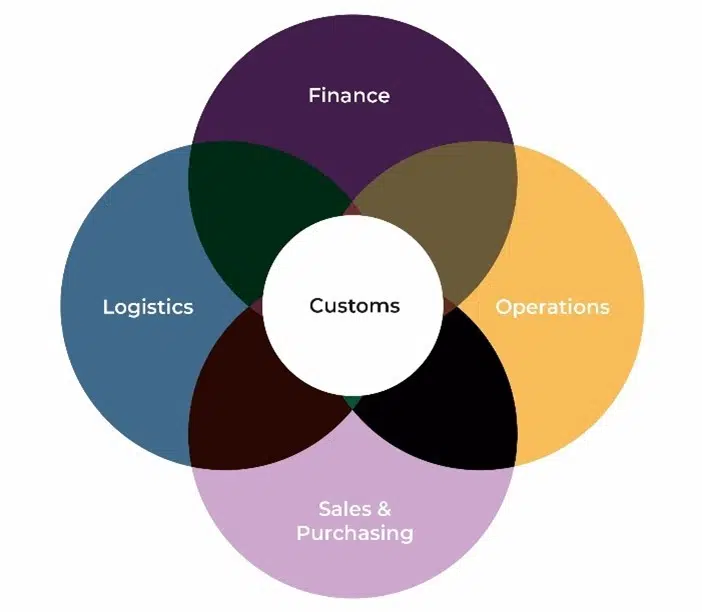

Typically, the customs function is split across several parts of a business with no dedicated ownership. Even with strong in-house customs teams, goals are typically not aligned with the wider business strategies. More often than not, ultimate responsibility falls with Finance as the department that manages the HMRC relationship, without them even knowing!

Many finance directors consider responsibility to be covered by another department or by an external party such as a freight forwarder or customs broker.

Due to customs compliance’s complexity and nuanced nature, a risk gap is often created by this lack of ownership and a FOFO. Worryingly, the responsibilities can end up with an individual with little training and who sees this as a lesser part of their role.

There are many reasons that employees avoid finding out more about the regulatory requirements and whether they are being met. Although they may have an inkling that things are not right, it can be a complex issue that they do not have the time to open.

For example, a business’s supply chain team may have FOFO because they do not have sufficient training to understand the regulatory requirements fully. It is human nature not to dig deep into subjects we do not fully understand, which might cause us harm or be viewed negatively.

In some cases, FOFO might be down to a lack of resources or support with the organisation. Teams may know what they need to do but be conscious that the time invested is not viable and result in the decision to delay until a time when this changes. This usually remains constant and can continued to be kicked down the road.

“FOFO is more common in customs compliance than businesses would like to admit. It is usually not a conscious decision by an individual but rather a structural and resource driven issue. This manifests into a much wider problem if left untreated as risk gas grow and exposures compound over time.”

Adam Wood, Head of Commercial, Barbourne Brook Limited

FOFO can create a culture of mistrust and secrecy within the supply chain, making it more difficult for teams to work collaboratively and address issues effectively. This can lead to delays in the supply chain, increased risk of non-compliance and significantly impact profit margins through increased cost of sales and import tax demands, penalties and fines.

As a customs duty consultancy, we are seeing much more activity by HMRC with customs audits. Customs Duty is now collected by the UK since leaving the EU. The good news is that customs compliance is an audit-based control, so businesses have time to rectify potential errors before an audit situation.

If your organisation has FOFO about its customs compliance obligations, there are several options to consider:

1) Seek external advice. Consult with customs consultants or legal counsel to get an outside perspective.

2) Conduct an independent audit: good corporate governance would suggest that even if businesses have experienced in-house teams, periodically, this must be tested. An independent customs audit will uncover both risk and opportunity within the current structure. Usually, the savings found during these audits far outweigh the cost of the project.

3) Implement a whistleblowing policy: the finance team could encourage employees to report concerns about non-compliance or unethical behaviour in a confidential way.

4) Provide training and resources: This can ensure that best practise is followed and that teams are fully aware of their departmental and individual roles within the process.

Barbourne Brook specializes in providing customs consulting services to large businesses, helping them to develop comprehensive compliance strategies. Our team offers an initial customs data analysis (MSS) using our cutting-edge analytical tool, CAT360, at no cost to you. This analysis provides valuable insights into your customs operations, identifying potential issues and opportunities for improvement.

If any of this resonates with you, contact Adam Wood from Barbourne Brook for a no-obligation chat, completely free of charge.

Related Posts

8 October 2024

Aligning Customs Strategy with Financial Goals: A Guide for CFOs

Are customs operations taking a…

16 September 2024

Nike’s €1.5 Billion Import Dispute: The Costly Risks of Underestimating Customs Regulations

Even the biggest names in the industry…

10 September 2024

HMRC’s ‘Modernised Authorisations’ Process Launches This Month

HMRC's ‘Modernised Authorisations’ (MA)…